Bitcoin

Bitcoin Bearish Signal: Miners Move 4.4k BTC to Binance

On-chain data shows Bitcoin miners have moved around 4.4k BTC to Binance, something that may prove to be bearish for the price of the crypto.

Bitcoin Miner To Exchange Flow Has Spiked Up Over The Past Day

As pointed out by an analyst in a CryptoQuant post, the recent transaction seems to have come from the Poolin mining pool.

The relevant indicator here is the “miner to exchange flow,” which measures the total amount of coins moving from wallets of all miners to all exchanges.

When the value of this metric is high, it means miners are sending a large number of coins to centralized exchanges right now.

Since miners usually transfer their BTC to exchanges for selling purposes, this kind of trend can be a sign of dumping from these chain validators. And thus, it can lead to a bearish outcome for the crypto’s price.

On the other hand, low values of the indicator imply these chain validators aren’t sending that much BTC to exchanges at the moment.

Such a trend can indicate miners aren’t putting that much selling pressure on the market right now, and can therefore have an either neutral or bullish impact on the value of the coin, depending on other conditions.

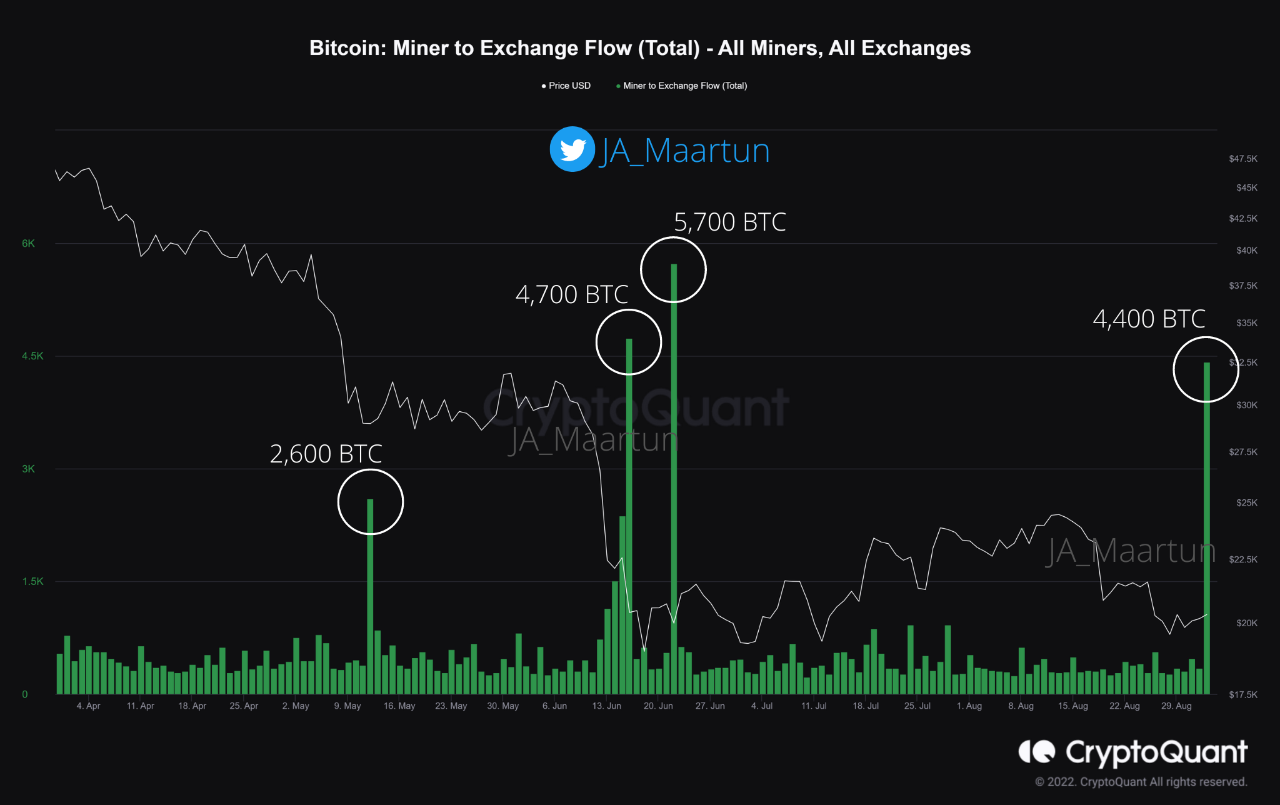

Now, here is a chart that shows the trend in the Bitcoin miner to exchange flow over the last few months:

The value of the metric seems to have been quite high recently | Source: CryptoQuant

As you can see in the above graph, the Bitcoin miner to exchange flow observed a large spike during the past day.

The transaction, which amounted to around 4.4k BTC in total, came from miner wallets associated with the mining pool Poolin, and was sent to the crypto exchange Binance.

During the last few months, there have also been three other instances of the miners sending coins from their reserve to exchanges. Each of these also happened to come around declines in the crypto’s price.

If the latest miner to exchange flow has indeed happened with the intention to sell, then this spike can be bearish for the value of the crypto.

BTC Price

At the time of writing, Bitcoin’s price floats around $20.3k, down 2% in the last seven days. Over the past month, the crypto has lost 13% in value.

The below chart shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has been moving sideways during the past few days | Source: BTCUSD on TradingView

Featured image from Marc-Olivier Jodoin on Unsplash.com, charts from TradingView.com, CryptoQuant.com